The general ledger is a collection of the group of accounts that supports the value items shown in the major financial statements. All transactions that have financial impact only need to be recorded in General ledger

This module includes:

- Need for General Ledger.

- What are Sub-ledgers?

- How do Sub-ledgers provide data to General Ledger?

Need for General Ledger

The main purpose of a general ledger system is to record financial activity of a company and to produce financial and management reports to help stakeholders make decisions.

For any company that has large number of transactions, putting all the details in the general ledger is not feasible. Hence it needs be supported by one or more subsidiary ledgers that provide details for accounts in the general ledger.

General Ledger Vs. Sub Ledger

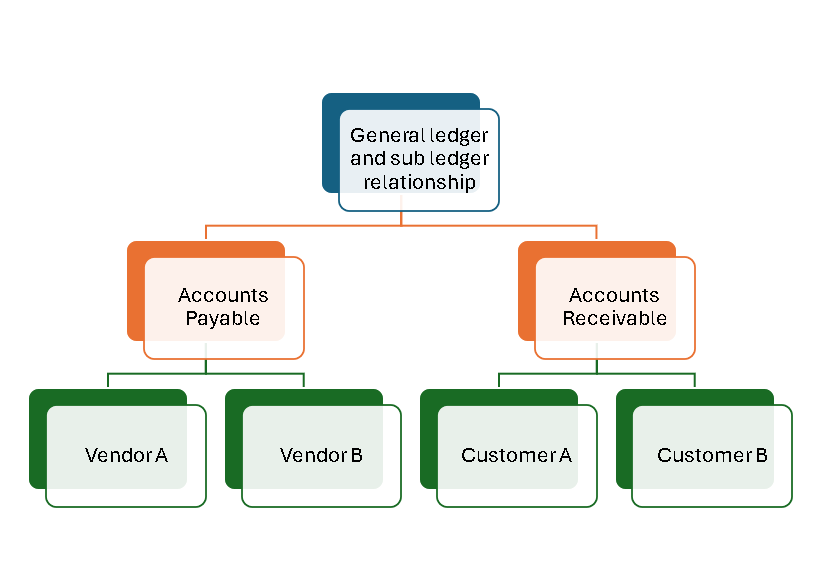

A subsidiary ledger is a group of similar accounts whose combined balances equal the balance in a specific general ledger account.

Balances in General Ledger are often supported by various sub ledgers. Subsidiary Ledgers facilitate recording of complete financial and other information related to the transaction.

Example

If a company does not maintain the Sub Ledgers and keeps all the information in the General Ledger, imagine what will be the size of your General Ledger, if you have 8000 customer accounts, 4000 supplier accounts and, 2000 items you trade in. On an average you enter into 5000 different transactions with your suppliers and customers who are spread across the globe. Even company has multiple Fixed Assets and Banks accounts that needs subledger and ledger concept.

In the Fixed Assets Subsidiary Ledger you can find all the details pertaining to fixed assets owned by the company. Apart from the financial details like cost of the assets, other information like date of purchase, date when asset was put to use in business, name of the supplier and storage location etc. is also captured in subsidiary ledgers.

An accounts receivable (AR) subsidiary ledger includes a separate account for each customer who makes credit purchases. The combined balance of every account in this subsidiary ledger equals the balance of accounts receivable in the general ledger.

The combined balance of every account in this subsidiary ledger equals the balance of accounts receivable in the general ledger. Subsidiary ledgers contain supplemental accounts that provide the detail to support the balance in a control account. Subsidiary ledgers also capture details pertaining to financial transactions

The general ledger account that summarizes a subsidiary ledger’s account balances is called a Control Account or master account.

Accounting transactions are captured in General Ledger at a summarized level and all relevant details for that transaction are available in the subsidiary ledger

Best Practices

Primary basis for best practices is simplification in order to achieve an enhanced level of efficiency. The two best practices that follow this approach are.

- Restructuring the general ledger to allow for the use of activity-based costing

- Using it as a data warehouse