As per law and for regulatory reporting, Companies should maintain more than one book for every fixed asset

That means that any transaction posted like an acquisition or disposal etc. will reflect in those books.

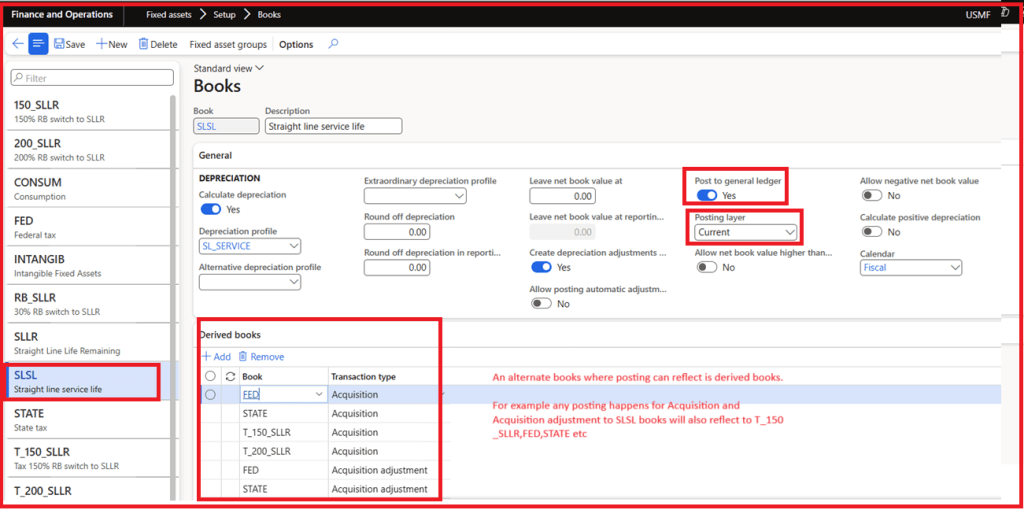

TAX Book: Books setup for Tax reporting with Post to general ledge is disabled and posting layer is None so that no posting happens at G/L level.

These are for TAX reporting purpose only.

Operations/Current layer book: When we want FA transactions to be recorded in books, enable Post to general ledger and select the layer as needed like current or operation.

Any posting done using this book SLSL will also post transactions to derived books.

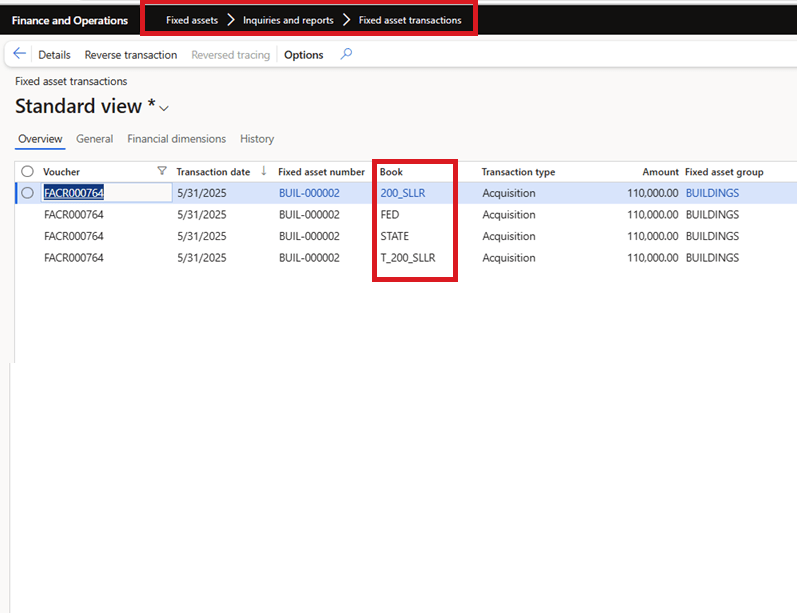

Now post journal to see the transactions.

Verify the transactions in inquiries and reports to see posting impacted to multiple books because of derived books linkage.